are union dues tax deductible 2021

The provision is effective for taxable years beginning after December 31 2021. Nonresidents must use PA Schedule NRH to apportion expenses for PA by days worked in PA or volume of business transaction.

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same T Good Essay Statement Template Cover Letter Sample

This prohibition was written into the tax reform legislation passed by the US.

. Click Itemized or Standard Deductions to expand the category then click Unreimbursed employee expenses - Subject to 2 of AGI limit. However you can deduct contributions as taxes if state law requires you to make them to a state unemployment fund that covers you for the loss of wages from unemployment caused by business conditions. Section 138514 of Subtitle I titled Allowance of Deduction for Certain Expenses of the Trade or Business of Being an Employee says The provision allows for up to 250 in dues to a labor organization be claimed as an above-the-line deduction.

Tax reform eliminated the deduction for union dues for tax years 2018-2025. You dont say whether you are a nonresident or part-year resident of PA. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills. The provision allows for 250 in dues to be claimed as an above-the-line deduction for taxable years beginning after Dec. The deduction is above the line meaning filers can exclude the cost of dues from their.

Furthermore you cannot claim a tax deduction for paying membership dues as a member of a pension plan. You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company. Only unreimbursed expenses for books supplies and equipment that you purchased for classroom use qualify for the 250 Educator Expense deduction.

Miscellaneous itemized deductions are those deductions that would have. Cuomo today signed new legislation allowing full union dues to be deducted from New York State taxes. If you and your spouse are filing jointly and.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. Tax reform eliminated the deduction for union dues for tax years 2018-2025. Prior to that year a union member could write off yearly dues as an unreimbursed employee business expense.

By pcteabufadmin January 25 2021 News. If youre self-employed you can deduct union dues as a business expense. The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools uniforms subscriptions to trade journals and many other items besides union dues that are often necessary for.

May 2 2021. From within your TaxAct return Online or Desktop click on the Federal tab. Union Dues or Professional Membership Dues You Cannot Claim.

More info Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. Union Dues Tax Deduction.

Educator expense tax deduction renewed for 2020 tax returns. To enter union dues in TaxAct. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too.

31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated. Four years after the income tax deduction for union dues was ripped out of the US. Advertisement More From Market Realist.

However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. During the year ending Dec. If an above-the-line deduction for union dues were enacted now on a permanent basis workers and unions would not be caught up in the decision that Congress will face in 2026whether or not to allow the law to automatically revert to pre-2017 tax law for a range of individual income tax provisions The absence of union dues and job expense deductions.

Union dues may be tax deductible subject to certain limitations. The Tax Fairness for Workers Act would also restore the deduction for other unreimbursed employee expenses including travel and the cost of tools. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020.

However the job-related expenses deduction is still available to people. Tax reform changed the rules of union due deductions. For tax years 2018 through 2025 union dues - and all employee expenses - are no longer deductible even if the employee can itemize deductions.

April 21 2021. Tax code pro-worker lawmakers are fighting to bring it back and for the first time make it available without itemizing. On smaller devices click the menu icon in the upper left-hand corner then select Federal.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. Miscellaneous itemized deductions are those deductions that would have. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense.

Line 21200 was line 212 before tax year 2019. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. Annual dues for membership in a trade union or an association of public servants.

Pennsylvania does allow a deduction for ordinary customary and accepted work employee work expenses including union dues uniforms and tools. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. Professional board dues required under provincial or territorial law.

A reminder for tax season. You cant deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund.

Tax Updates For Entertainment Performers Youtube

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

What Are Payroll Deductions Article

Can I Claim Tax Relief On Professional Subscriptions

How To Organize Tax Documents And Receipts Housewife How Tos

Claiming Back The Tax On Your Pda Membership The Pharmacists Defence Association

Claim Tax On Your Bma Subscription

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Claiming Back The Tax On Your Pda Membership The Pharmacists Defence Association

Claim Tax Back On Union Fees Tax Rebate Services

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

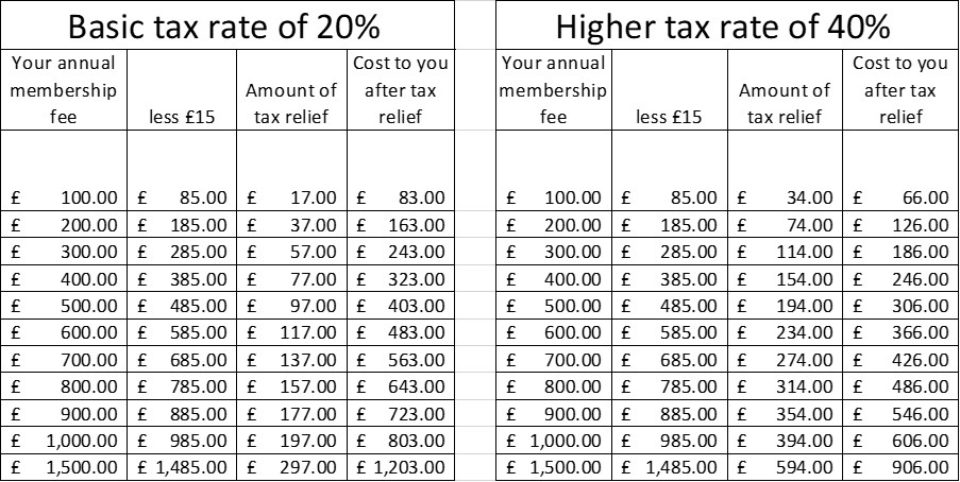

Income Tax Relief The Chartered Society Of Physiotherapy

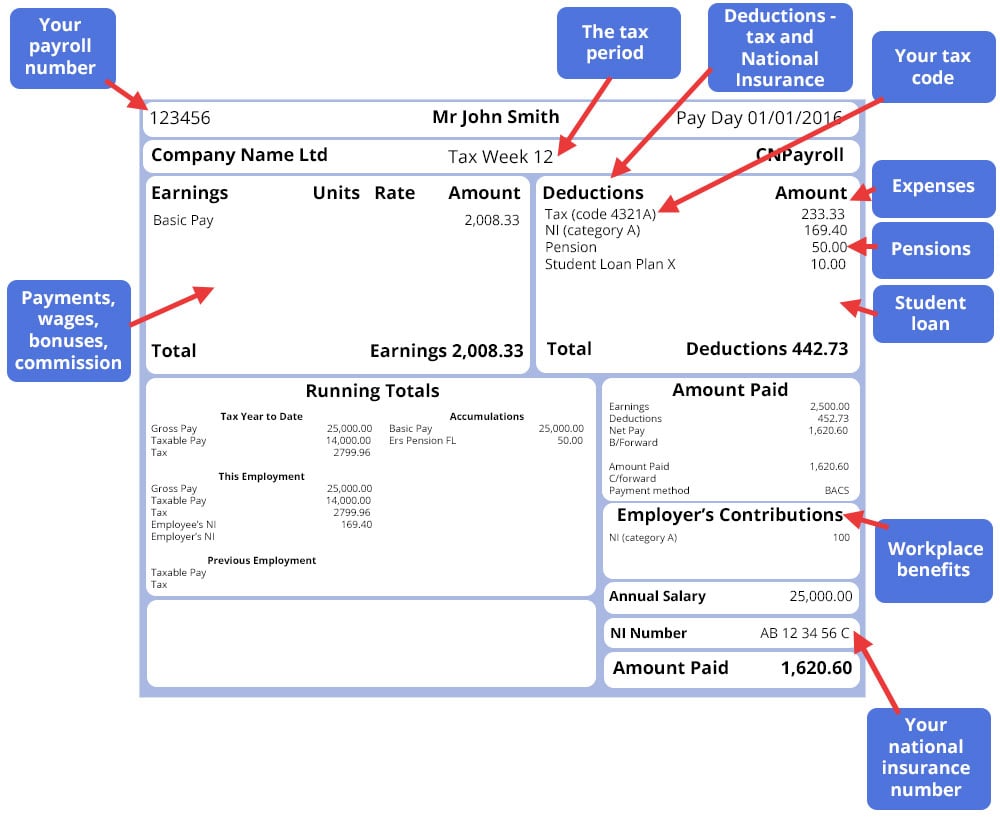

Payslip Checker Your Payslips Explained Reed Co Uk

Amazing Way To Take Health Insurance As A Tax Deduction In 2021 Tax Deductions Health Insurance Deduction

Pin By Wayne Artis On Quick Saves In 2021 Richmond Va Union Dues Midlothian

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)