nj bait tax explained

As the New Jersey Division of Taxation rolled out its interpretation and guidance of the Business Alternative Income Tax BAIT serious concerns surfaced. 1418750 plus 652 for distributive proceeds between 250000 and 1000000.

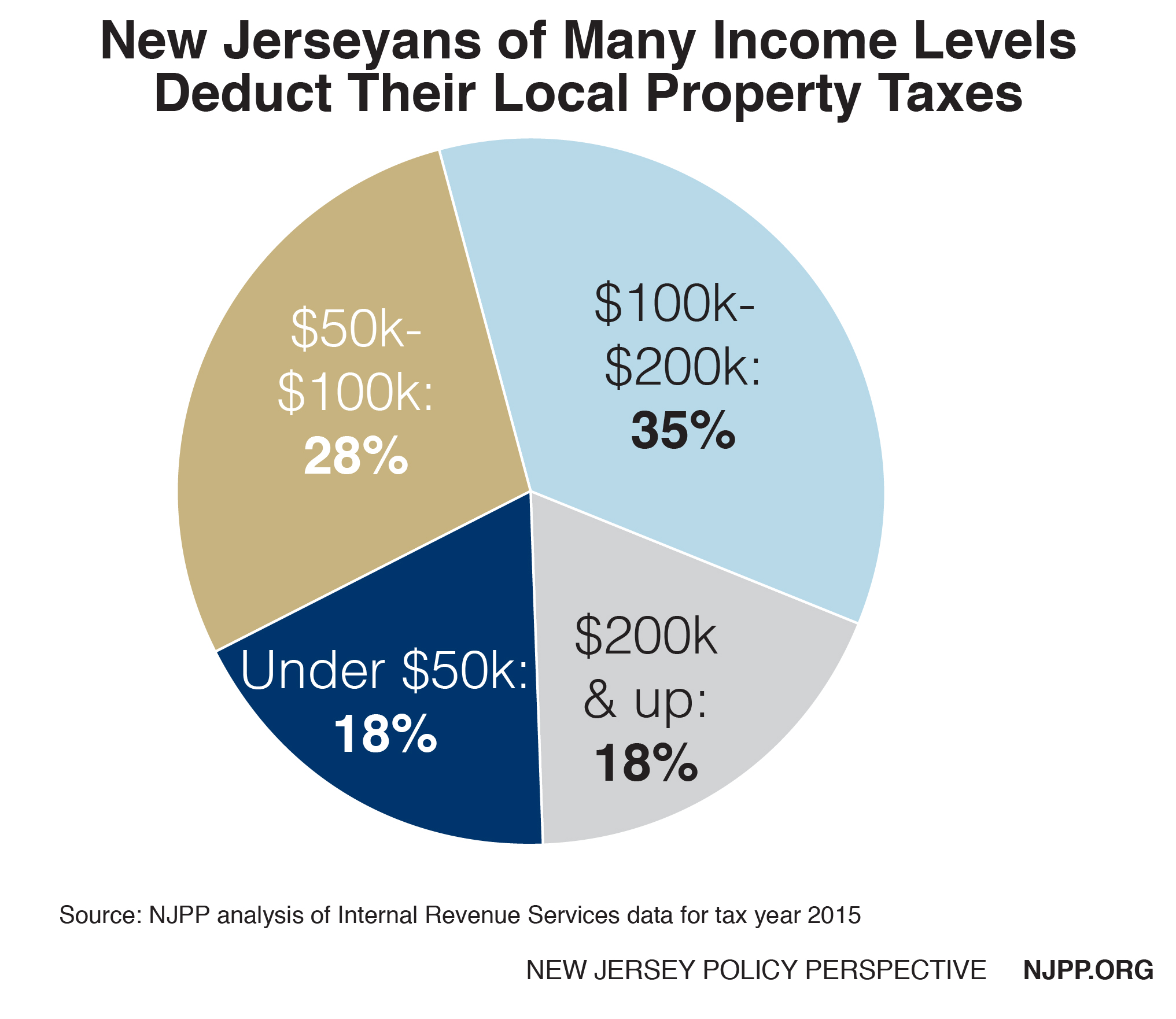

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each Year New Jersey Policy Perspective

In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT.

. Enticing Businesses with New Jersey BAIT The pass. A tax-saving technique for New Jersey pass-through businesses has been improved under a new state law enacted this week that will help small business. Nj bait tax explained Sunday October 9 2022 Edit.

Bracket Changes As a result of the amendments the BAIT increases to the. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax SALT deduction cap. What It Actually Is.

Pass-Through Business Alternative Income Tax Act. This change does not affect TY 2020. Earlier this week Governor Murphy signed into law a bill.

New Jersey Enacts Legislation to Fix its Business Alternative Income Tax BAIT By Len Nitti January 21 2022. PL2019 c320 enacted the Pass-Through. Despite the confusion caused by calling it an exit tax the law simply requires the seller to pay state tax in advance calculated as follows.

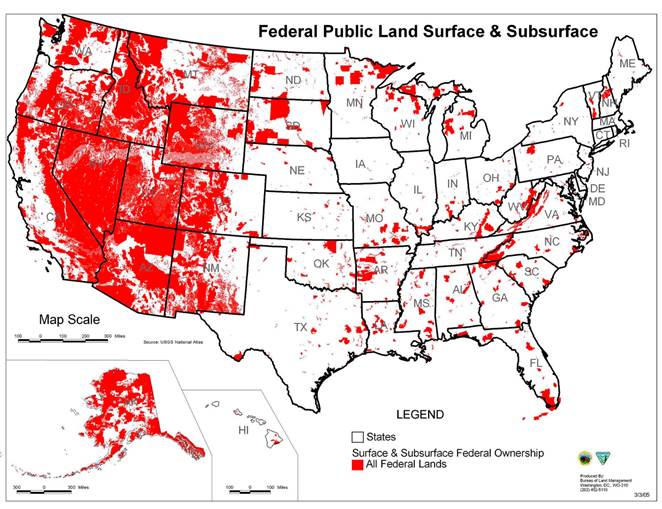

The New Jersey BAIT was designed as a work-around to the 10000 federal limit on the deduction of state and local taxes enacted in the Tax Cuts and Jobs Act of 2017. New Jerseys PTE workaround has received a lot of attention as it is one of the highest-taxed states in the nation. NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to.

The New Jersey BAIT was designed as a work-around to the 10000 federal limit on the deduction of state and local taxes. This is an entity-level tax to work. On January 13 2020 New Jersey Governor Phil Murphy signed the NJ SB3246 Pass-Through Business Alternative Income Tax Act into law.

Its estimated to save New Jersey business owners 200 to 400 million. The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income. Pass-Through Business Alternative Income Tax Act.

The BAIT for New Jersey S Corporations continues to be limited to New Jersey-sourced income. The tax is calculated on every members share of distributive proceeds including tax exempt. First if you have a primary home in New Jersey for which you paid 200000 and are selling for 275000 you need to look at Form GITREP3 - Sellers Residency.

New Jersey withholds either 897. For the 2020 tax year the four tiers of income tax rates are as follows.

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan

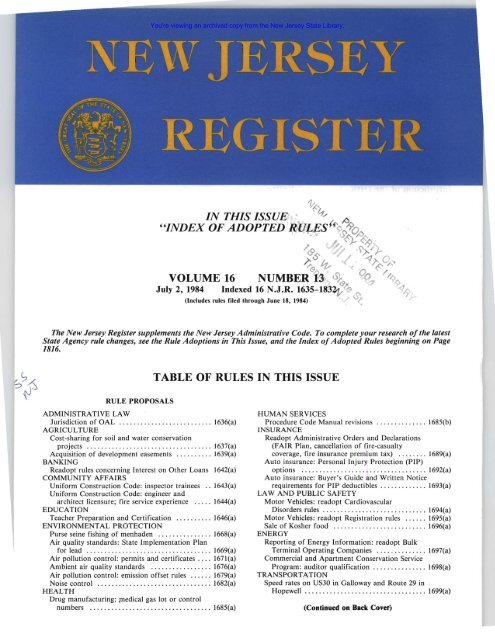

Number 13 Pages 1635 1832 Law Library The New Jersey State

2018 Tax Total Tax Table Moorestown Township Nj Official Website

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

Livingston Accountant Addresses New Jersey Business Alternative Income Tax Livingston Nj News Tapinto

House Just Voted To Restore Your Property Tax Break As Part Of 1 75t Spending Plan Nj Com

New Jersey Nj Tax Rate H R Block

Maybe Fred Benenson On Twitter Yeah This Dude Definitely Doesn T Want To Pay His Taxes On Buying The 3m Book But Hey This Is What Crypto Is Actually Good For Right Avoiding

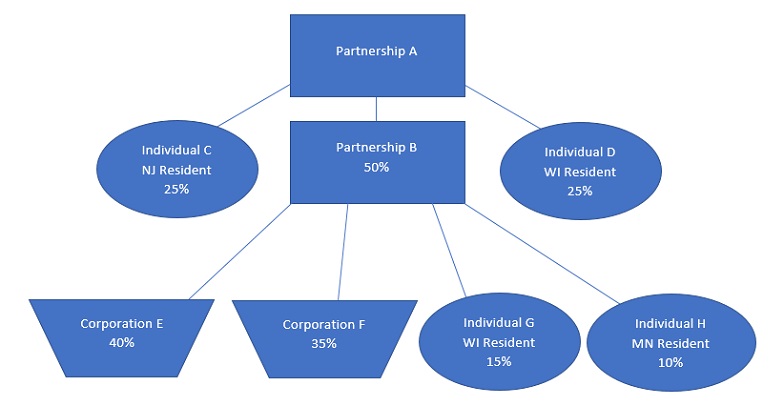

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

Sales Tax Conflicts Where Two States Tax The Same Transaction

What Is The Pass Through Business Alternative Income Tax Act

Understanding The Pte Tax In The Tri State Area Berdon Llp

What You Need To Know About The Biden Tax Plan

New Jersey Businesses Should Consider Salt Deduction Limitation Withum